We use cookies to analyze traffic and improve your experience. We may also share your information with our analytics partners to improve our website, as detailed in our Privacy Policy. You consent to our cookies if you continue to use this website.

The 2021 steel market proved to be unlike any other and posed challenges for procurement teams across all industries. In the first half of the year, economic recovery and manufacturing demand surged. As demand outpaced supply, steel prices skyrocketed due to supply chain constraints and material shortages.

Many factors impacting the steel market now will continue to be of great influence next year. As 2021 draws to a close, I wanted to share some of the market forces that the Leeco Steel team will be monitoring in 2022 to gauge steel plate pricing outlooks to better inform our customers.

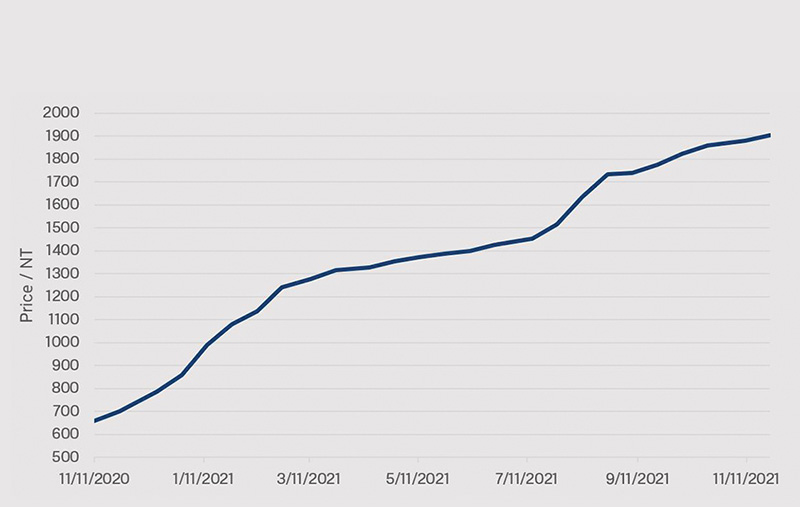

Steel plate prices, as reported by various industry indexes, rose to unprecedented levels with no sign of slowing in 2021. However, plate prices grew at a softer pace in Q4 2021, and experts expect prices to stabilize in early 2022.

November 2020-November 2021 Steel Plate Prices, as Reported by Various Industry Indexes

According to the World Steel Association’s October Short Range Outlook Report, we can anticipate global steel demand to increase 2.2% year-over-year in 2022 from 1,855.4 Mt to 1,896.4 Mt. The report states that steel demand across the globe recovered faster than anticipated in 2021, and we can expect this trend to continue.

China, one of the world’s largest producers and consumers of steel, is expected to have no growth in demand during 2022. In 2021, we saw China experience negative demand growth after a slowdown in real estate activity and a government-placed cap on steel production. These factors will likely persist over the next year, however they’ve given recent signals that controls on production may be loosened slightly in the coming months.

The report says that we should see steel demand in North America increase 5.4% year-over-year from 129.6 Mt to 136.5 Mt. Indicators in the U.S. that could impact steel demand include the semiconductor chip shortage, oil prices and the infrastructure stimulus bill, all of which are things we at Leeco will monitor in the coming year.

Raw material shortages severely disrupted manufacturing output and supply chains in 2021. According to analysts, we will see these shortages persist through the majority of 2022.

The global semiconductor chip shortage caused major disruptions in various sectors, such as the automobile industry. Experts say we could see this shortage continue through 2022 and possibly into 2023, but changes in the way semiconductors are manufactured, including a shift to tech companies producing chips in-house, could help to alleviate the shortage.

Another raw material issue we will watch closely over the next year is a magnesium shortage. Chinese exports of magnesium, a material used in various manufactured goods, plunged in 2021 as the country reduced output due to an energy cut. As a result, Europe is running low on the material, and we could see the U.S. face magnesium shortages in early 2022.

Material shortages such as these can have a massive “ripple effect” on all steel and metal materials used in manufactured goods – including steel plate – which is why we will closely monitor these supply deficiencies.

Finding labor has been a challenge for all industries, but particularly for manufacturers. While 78% of jobs lost during the pandemic were added back by September 2021, the manufacturing sector has only regained 75% of its 1.4 million jobs lost during the pandemic, lagging behind other sectors.

Manufacturing also has a 27% higher quit rate compared to other sectors and is lagging in wage increases, which are factors contributing to the industry’s labor shortage.

Labor shortages are also disrupting many other sectors, such as transportation, which we will discuss later in this article.

We watched the pandemic disrupt all aspects of supply chains, and analysts say these disruptions will continue through the first half of 2022. An increase in closures due to virus outbreaks and expected shipping volatility around the Chinese Lunar New Year are a couple of the factors we could see contribute to supply chain disruptions.

However, analysts believe that we could see supply chain disruptions ease in the latter half of 2022 as consumer demand softens, inventories reach that of pre-pandemic levels and global shipping capacity increases.

Transportation faced great volatility during the pandemic, and we can expect disruptions to this industry to continue through 2022 and beyond.

Not only have rising fuel prices led to an inflation of freight rates for all shipping modes, but a labor shortage is making it challenging for transportation companies to keep supply chains moving.

The trucking industry, in particular, is facing a severe labor shortage. According to the American Transportation Association, the truck driver shortage hit a historic high of 80,000 in 2021, and this number will only continue to climb. As a result, trucking companies are taking actions such as raising wages, and the government has relaxed regulations by allowing younger people to become drivers and changing rules regarding required breaks.

However, analysts say that solving labor shortages in transportation will be a joint effort between multiple parties, from trucking companies to the government to the businesses receiving shipments, and that there is no single solution to the problem.

Transportation issues can impact freight rates associated with transporting steel plate and the ability to find capacity to transport materials, which is why our team is closely monitoring this area.

In November 2021, President Biden signed a $1 trillion bipartisan infrastructure bill into law. This infrastructure bill created $550 billion in new funds for transportation, broadband and utilities, including the following areas:

While funding from this bill will be distributed over a 5-year period, we could see an increase in funding for road infrastructure projects starting in 2022. These projects could create higher demand for mild carbon steel plate materials used in infrastructure and road plate applications in the second half of 2022.

We saw crude oil prices spike in 2021 as demand outpaced supply, and, according to analysts, this trend will continue and place further upward pressure on prices.

Analysts from Goldman Sachs predict that oil demand will achieve a new high in 2022 and prices could reach $100 per barrel. Similarly, JP Morgan analysts forecast that oil prices will reach $125 per barrel, and Barclays analysts estimate a more modest rise of oil prices to $80 per barrel.

The oil and gas industries are a major end user of steel plate products, and many other manufacturing projects are closely tied to oil prices. Our team will carefully monitor crude oil pricing trends throughout 2022.

Keeping track of the market forces shaping steel is crucial to ensure you make strategic material sourcing decisions for your business. However, knowing which metrics are important to monitor – and finding the time to analyze them – can be a challenge.

Leeco Steel publishes a monthly steel plate market report to keep our customers informed. This report includes high-level insights on the news and metrics impacting the steel industry. Sign up below to receive our “Steel Snapshot” report directly to your inbox.

Looking for a quote? We recommend you use our quote builder or submit a request for quote document via our RFQ Form.

Quote Builder Submit an RFQ