We use cookies to analyze traffic and improve your experience. We may also share your information with our analytics partners to improve our website, as detailed in our Privacy Policy. You consent to our cookies if you continue to use this website.

The first six months of 2021 started out strong, with the economy making a sharp recovery and the steel industry quickly bouncing back from last year’s slump. Despite this early recovery, however, steel market outlooks for the second half of 2021 remain cloudy, with potential for some late year volatility.

Leeco Steel is closely monitoring current market conditions to gauge their potential impact on steel plate pricing and demand later this year. Here are a few of the metrics that our team will be keeping a particularly close eye on.

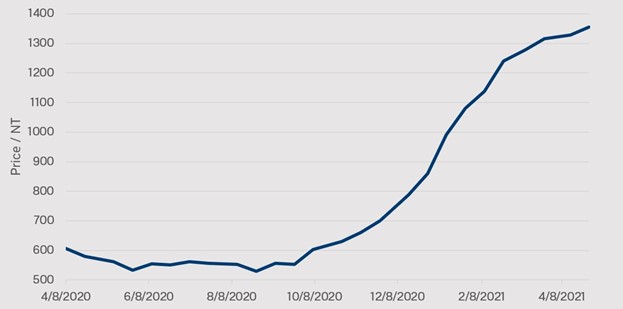

We saw steel plate prices increase aggressively during the first half of 2021 as demand for plate products greatly exceeded the available supply. Steel mills were slow to fully re-start operations after production cuts made in 2020, which meant that service centers were unable to replenish low inventory levels.

April 2020-April 2021 Steel Plate Prices, As Represented by Various Industry Indexes

This historic rise in plate prices persisted longer than anticipated by many industry experts. We can expect prices to ease at some point – either when supply increases or demand pulls back, or both – but experts are unsure as to when this will happen.

With inventories and imports appearing to remain low for the near-term, it is logical to think prices have room to run a bit further through 3Q21. The incredible strength of the hot rolled coil market will undoubtedly continue to pressure plate prices upward as well. Admittedly, plate pricing was partially propped up through 1Q21 by the hot rolled market, however, it seems plate currently has the strength to stand on its own for the coming quarter.

Global demand for all steel products may increase greater than initially expected, according to an April 2021 outlook report conducted by the World Steel Association. In this report, World Steel forecasts global steel demand to grow 5.8% year-over-year in 2021 and reach a total of 1,874 million tons. In the U.S. specifically, World Steel says we can expect steel demand to grow 8.1% year-over-year and reach a total of 86.5 million tons.

Near the end of March 2021, President Biden announced his proposed plan for an infrastructure bill. Biden’s plan, which would cost $2 trillion and be funded by raising the corporate tax rate, outlined investments in the following areas:

Bi-partisan conversations about an infrastructure bill took place between Congress leadership and the White House in mid-May, with the cost of the plan, corporate tax rate increase and scope of infrastructure split along partisan lines and being points of potential compromise. Experts say we can expect an infrastructure bill to go to Congress for a vote – and potentially be passed into law – during the second half of 2021.

The progress of an infrastructure bill is something we at Leeco are closely watching. Not only will passing an infrastructure increase demand for structural steel products and benefit the construction and infrastructure sectors, but it will also be key in making improvements and updates to deficient structures across the country. Leeco is proud to support MSCI’s Build Now initiative, which helps build awareness and support for infrastructure investment.

As the manufacturing sector and economy continue to recover, we are seeing inflation rates begin to rise. In April, the Consumer Price Index rose 4.2% year-over-year, higher than expected. We are also noticing prices for consumer goods, energy and raw materials rising as well.

Despite some growing inflation concerns, Fed officials have stated they will not make any changes to current interest rates unless inflation averages over 2% during an extended period of time. Fed officials also said the current inflation rates are “transitory,” however, when considering the massive increase in money supply, it leaves many to wonder if sustained higher inflation rates are on the horizon. For now, Chairman Powell dismisses the idea.

Analysts surveyed in NABE’s recent quarterly survey shared similar sentiment, stating that we can expect inflation pressure to be short-lived and ease in the second half of 2021. Analysts surveyed also predicted that U.S. GDP will grow at an annualized rate of 8.5% in the second half of this year as inflation pressure falls.

Inflation rates can greatly impact prices of many goods, including the raw materials used to manufacture steel plate products, which is why we at Leeco are closely watching how inflation rates evolve in the second half of this year.

After facing a year of declining or stagnant manufacturing activity in 2020, we are seeing strong manufacturing sector recovery as the ISM Manufacturing PMI Index – which measures manufacturing activity – reaches record-highs.

April 2020 - April 2021 ISM Manufacturing PMI Index

Despite this record growth, supply chain bottlenecks are currently limiting the number of orders that can be produced as manufacturers struggle to find raw materials and labor. Semiconductors, which are used in cars, computers, televisions and appliances, are one material in great shortage, thus causing production to slow or halt in these industries. Experts say we can even expect that particular shortage to last until 2022.

We are also seeing supply chain constraints impact new home construction. Housing starts fell 9.5% year-over-year in April as builders hesitated on starting new projects due to rising lumber and other raw material costs.

Manufacturing is a major market served by the steel industry, so the level of manufacturing activity can have a big impact on steel plate demand and, therefore, prices. Leeco will keep an eye on manufacturing sector growth and recovery for the remainder of the year.

Keeping track of key market indicators is crucial to ensure you understand the market forces impacting the steel plate market and can make more strategic sourcing decisions for your business. However, it can be challenging to find the time to fully analyze all the market forces shaping steel.

Leeco Steel publishes a monthly Steel Snapshot market report that share brief, high-level insights on the key news and metrics impacting the steel industry. Sign up to receive this report right to your inbox via the button below.

Steel Snapshot Sign-UpLooking for a quote? We recommend you use our quote builder or submit a request for quote document via our RFQ Form.

Quote Builder Submit an RFQ